CHINA: Carbon Neutral by 2060

the business opportunities for EU energy solutions providers

Session One: Security of Supply (Summary, Presentations)

- Octavian Stamate – Counsellor, Energy and Climate Action, EU Delegation to China

- Matteo Tanteri – Chairman and CEO, SNAM CHINA

- Rudolf Huber – President, LNG EUROPE

- Jan Stambasky – Vice-President, R2GAS

- Matthew James – ENERGY POST – Moderator

Video of session one

(English subtitled)

Discussion highlights

Since last year, the gas market has changed significantly, with a very different situation in the EU and China. Whereas the EU is trying to become independent from the largest supplier, Russia (supplied 45% of total gas demand in 2021), China has a more diversified supplier arrangement. Due to the Russian invasion of Ukraine, Europe is facing significant supply shortages.

Current situation in Europe

- In 2021, Russia was the largest supplier of gas to the EU, accounting for 45% of total gas imports (pipeline and LNG).

- Due to the Russian invasion of Ukraine, Europe is facing significant supply disruptions. Urgent actions are required to stabilise security of supply in the EU, i.e., diversification of supply. In the long-term, demand could be covered by domestic renewable gases.

- Large price differences for natural gas in Europe compared to Asia and North America could lead to economic downturn and disturb social balance.

- REPowerEU plan – EU’s response to Russia’s invasion in Ukraine, aiming to reduce demand for Russian gas by two-thirds by the end of 2022 by reducing gas demand, diversifying supply and boosting gas storage.

- Under the European gas demand reduction plan, Member states agreed to reduce their gas demand by 15% until spring 2023.

Current situation in China – China’s 14th Five Year Plan (FYP)

- Gas is key to meet China’s dual carbon targets. China’s gas market is mainly influenced by the 14th FYP, which emphasises the role of LNG.

- China’s approach to security of supply focuses on strong diversification of suppliers, while maximising the use of domestic resources.

- China signed long-term contracts with major LNG suppliers (USA, Qatar) years ago.

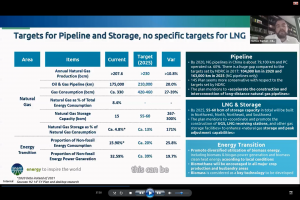

- Infrastructure and storage capacity are currently insufficient – which is why there are ambitious scale-up targets.

- In 2020, Pipechina was founded, to be a major player in the transition from coal to gas.

Link between Europe and China

- China’s LNG imports from Russia increased significantly in the last six months during the war. At the same time, China has started exporting LNG to Europe, about 7% of EU’s LNG imports come from China.

- However, China bought only 7.6 bcm of gas from Russia – a small fraction of what Russia should supply to Europe under normal market conditions and the purchases were already planned years ago.

- China is not seen as a substitute market for Russian gas from European gas fields, as the transport would be too costly because of the geographic distance.